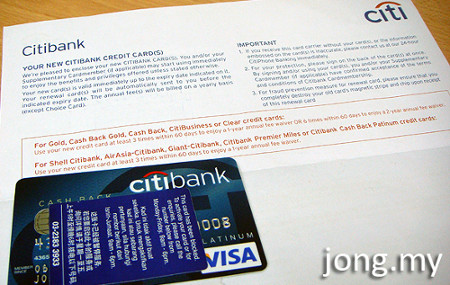

I was given a free card recently by Citibank and for a while there I thought to myself wow it’s time of the year a free reminder to do your shopping.

It’s good isn’t it to live in a world where almost everything are preplanned for you from a company that never sleep to delight you. It’s almost perfect.

Ironically on the same week Maybank doubled my credit limit!

The truth about banking is that they will not happy until they make sure they gives the “best service” to their customers that is to pushes more credit out the door to their valued customers to “enjoy”.

Citibank however promises an attractive cash back on the petrol. 5% or RM30 max cash back whichever higher monthly. So basically if you spend RM600 a month for the next 12 months you literally save up RM360 per year. Not too shabby.

I do not response to such offer normally but increase of petrol 3 times a month makes me rethink.

So what’s the catch? Soon as you activate the card your bonus points you have been accumulated for many years would be write off. It’s savvy to say that you should redeemed the points before you do your activation. In my case the activation also means upgrade from gold to platinum card.

The card is also free from annual fees charges for a year and chargeable at RM195 upon renewal. I was assured with the employee’s verbal promise of fees waiver by calling in next year.

I read these fine prints and it’s quite interesting. Retails Protection Plan, Lifestyle Privileges and healthcare. I am interested with the One Complimentary Blood Cholesterol check provided by KPJ. The 30% discount on Executive Screening is very generous.

Using credit cards is more of an excuses rather than a real deal. You get more debts rather than saving. What the bank perceived as a benefits and perks are actually means more way for people to have a reason to owe the bank and in returns the bank earn its “rightful” income in rendering the service.

At the end of the day it’s really come down to the discipline of the consumer themselves. If you’re familiar with pawnshops ghost story, credit card is the closer connection between exchanging your soul and things you want in life.

7 responses to “Free & Pre-Approved Citibank Cash Back Platinum Card”

@Daisy hugs hugs credit card can be evil when we misuse it 🙂 Happy weekend.

@Chegu Hahahaha I like the idea salary increased by 100% 😀 It’s a good call for not to upgrade. I have once cancelled off my Citibank card but than they re-offer me and I like sales people any how… I just say okay to take it back.

Many do not study or have the knowledge of financial planning. I was working for a bank for 7 years and we were not thought a single thing call financial planning. Everyday we were expose to how to “spend” instead of how to “save”

So don’t be surprise some bankers are very bad in debt by nature.

Nice to see you and Gong Xi Fa Cai every one 😀

i am not very discipline when it comes to spending money. so whenever a bank try to offer a new credit card to me or to increase my credit limit..i will say no or dont respond at all. if my pay got increased 100%, then only i can think about raising up my credit limit. 🙂

lol ~ Net , why not u juz use that card and buy a new 5D Mark II ?? 😀

@Nino That would be cool! I want to eat porridge and watch beautiful Taiwanese and snap some photos with Canon 5D MKII!

@Stewart borrow your MKII to shoot beautiful girl in Taiwan hahahahha That card can buy another copy of camera 😀

Our credit card we have right now has cash back on groceries that we buy. It is a good deal and it is handy to have a credit card to use, but you have to be very careful that you know what you are doing and pay the bills on time. You are right, it really is up to the discipline of the consumer.

Well..that’s good !

Can I give you free resident permit for Taiwan? Then I can go out for breakfast with you every day 😉